Meeting of Banks’ Union (UFBU) with negotiation committee of Indian Bankers’ Association (IBA) held on 29th September 2018 was concluded without any outcome. IBA was not agreed on any further hike on their earlier offer of 6%. Banks’ Union are insisting on salary hike of minimum 15% on payslip.

The major highlights of the meeting was representing the “Performance Linked Annual Increment” for bank employees by one of the member from IBA negotiation committee. The rough sketch which was presented by IBA to Banks’ Union for discussion was purely based on Fixed plus variable pay hike linked to individual Bank’s Performance.

IBA has offered to categorize the bank in three broad category on their performance metrics i.e. Net Profit on YoY basis and Return on Assets (RoA),

As per offer given by IBA :

Category ‘A’ Bank : All such banks which are having Return on Assets (ROA) greater than Zero and Percentage increase in YoY Operating Profit higher than 15%. The base year considered for the calculation is 31st March 2018.

Mandatory Criteria : Operating Profit : > 15% | ROA – >=0

Category ‘B’ Bank : Similarly, for category B banks the criteria are :

Mandatory Criteria : Operating Profit : 7.1 – 15% | ROA – (-)0.24 – 0

Category ‘C’ Bank : Similarly, for category C banks the criteria are :

Mandatory Criteria : Operating Profit : 0.01% – 7% | ROA – (-)0.75 – 0.25

Banks will be considered for granting salary hike on the basis of above mentioned criteria. Corresponding annual hike will also be given based on the structure mentioned above.

If Bank’s Union accepts the demand of IBA for performance linked annual hike, all such banks which don’t achieve the target as per the defined criteria as mentioned above for any salary hike.

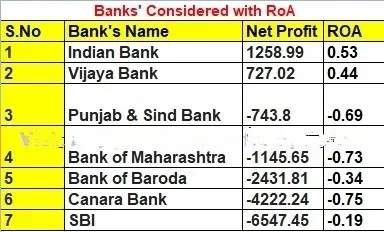

This is the list of Public Sector Bank with their Net Profit and Return on Assets for year 2017-18. IBA has considered the March 2018 as base year for annual increment.

List of Public Sector Banks in India with their Net Profit & ROA as on 31st March 2018.

The minimum Return on Assets (RoA) defined for granting salary hike is (-)0.75. Here is the list of all such banks which are having RoA & Net profit under consideration.

And this is the list of Banks with higher RoA and may not consider for Salary hike as per 11th Bipartite.

It means smaller banks’ employees will get the smarter package than bigger bank. As like in this case Vijaya Bank employees will get the higher annual increment than State Bank employees. I don’t understand any logic behind it.

As per circular of ufbu operating profit will be considered while in this article net profit is taken. Please also update the operating profit of psu for f.y.2016-17 and 2017-18 if available

ReplyDeleteAs such entire banking system is on erratic policy structure pay hike holiday be declared till system normalises Incentives to performers be given instead of hike on growth parameters

ReplyDeletewhy bank employees are targetted.

ReplyDeleteEVEN PENSION WE ARE UNABLE TO ACHIEVE

GOVT SAYS SENIOR CITIZENS

WHAT EQUALITY IS SHOWN

CONCESSIONS GIVEN TO SENIOR CITIZENS

SHOULD BE PERMANENT IN NATURE

SHOULD NOT PULL BACK

SECONDLY VERY FEW RETIREES SURVIVE

AFTER 75

GOVT SHOULD CONSIDER THIS

EVEN THOUGH HE SURVIVES

PENSION IS UTILISED FOR HEALTH CARE

WE ARE NOT GOING IN RIGHT DIRECTION

This is ridiculoud.IBA has gone mad. It is the policies of RBI n govt that banks r in loss. Why they cant catch defaulters. Only employee of banks r targeted. No rules for Malya, Neerav,Kothsri n many more like that. Only rules 4 bank employees. Why double standard?

ReplyDelete